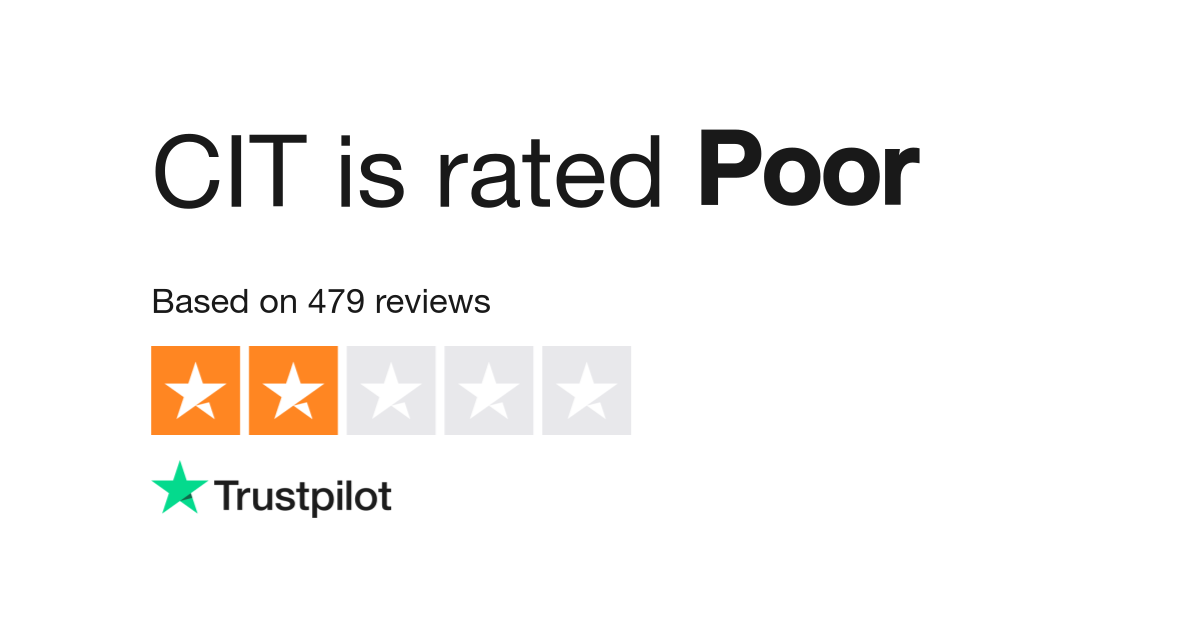

Cit Equipment Finance Reviews

Working capital equipment financing sba loans and franchise financing.

Cit equipment finance reviews. Cit reviews 239 excellent. Cit bank offers loans and leases for restaurant equipment point of sale terminals construction equipment commercial vehicles and computer hardware and software. Discover capital equipment financing. Very responsive whenever you have questions about your business financing.

California finance lender loans arranged pursuant to department of. Cit has been our go to for computer cit has been our go to for computer equipment since we were referred by apple business services. Cit direct capital is a new hampshire based online funder serving small businesses. The company offers three categories of financing.

We offer flexible terms of up to ten years with advance rates tailored to the equipment and credit strength of the borrower. Cit bank has several savings options that offer competitive rates with low fees. You ve already flagged this. The company offers several categories of financing.

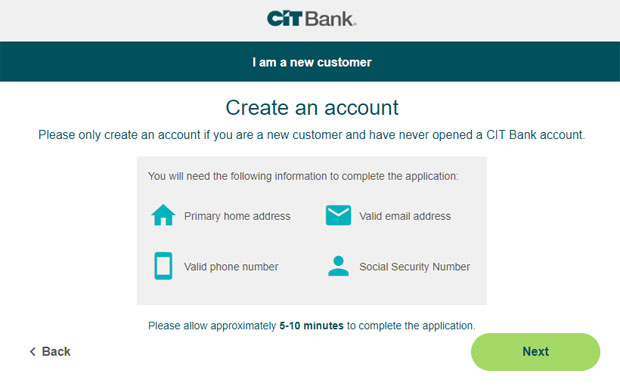

Checking savings cds. I interviewed at cit irvine ca in april 2020. Once they saw my resume i got a phone interview where they asked a lot of questions in depth so make sure it was a good fit then scheduled in person interview after with branch manager. Working capital equipment financing and franchise financing.

Cit bank is an online only bank that is entirely digital and offers competitive deposit products and home loans. Cit equipment finance designed for small and middle market companies cit equipment finance helps organizations in a variety of industries grow their business. Cit direct capital is a new hampshire based online funder serving small businesses. It is a division of new jersey based cit bank.

Get funding for equipment technology working capital franchises and more. You send in resume apply online check out the careers section on the main company website. This review will focus on cit direct capital s equipment financing line. The company ensures it has the funds to finance these ventures via investment portfolios in key markets including technology healthcare and franchise finance.

Cit offers flexible financing options to meet your small business needs. It is owned by cit whose history dates back to 1908 when it began by offering. The process took 3 weeks. You may be able to secure up to 500 000 with only an application while larger financing amounts up to 1 000 000 would require additional documentation and financial information.

:max_bytes(150000):strip_icc()/GettyImages-1553794991-dbfbf6f283984a1fa229d63a4f7a8dcf.jpg)